| |

Of course real inventory systems are not deterministic

as in the models considered previously. Although the models

that neglect uncertainly may yield results that are useful in

many contexts, it is possible to describe and analyze models

that explicitly include the uncertainty associated with some

aspects. There are many aspects that might be uncertain including

the lead time, the quantity that is actually received given

the amount ordered, or the amount demanded in any time interval.

It is impossible to provide analytical results for the most

general case. Here we consider only uncertainty in demand.

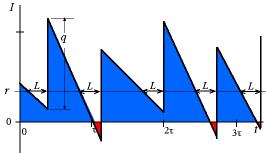

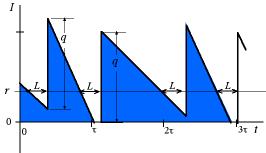

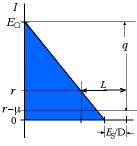

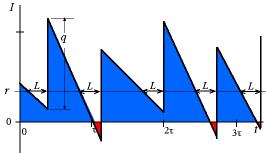

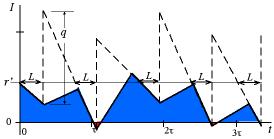

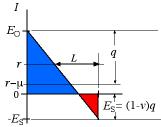

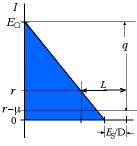

One possible stochastic inventory situation is

illustrated in the figure above. This is called the (q,

r) system and the add-in provides analysis and optimization

tools for this system. As for deterministic systems, the inventory

level is affected by demands and replenishments, but here we

show the demand process as variable, sometimes the demand rate

is high causing quickly declining inventory levels, while at

other times the demand rate is low with the inventory declining

more slowly. For this system, we have some inventory level r

at which we place an order for an inventory replenishment. This

is called the reorder point. The amount ordered is q,

the order quantity. After we place the order, we must wait for

some interval, L, the lead time, before the inventory

is replenished. Added to the models for the stochastic systems

are the risks and costs of shortages, shown as the red areas.

If the demand is high during the lead time (greater than r),

some customers will not be satisfied. We can set the reorder

point high to make shortages unlikely, but that will increase

the inventory levels, shown as the blue areas. The order quantity

affects both shortages and inventories as well as the cost of

replenishment. Our solutions will set system variables to balance

the costs of inventory, shortage and replenishment.In the following

we describe some of the options available for analysis.

The add-in allows stochastic

inventory models to be defined. The models allow the demand

during the lead time to be governed by a probability distribution.

All results are based on mathematical formulas that are described

in theoretical textbooks on inventory theory.

To create a model choose

Add Inventory from the menu. When shortages are allowed,

several options are presented for demand. The Deterministic

option creates the models considered previously. The other three

options define the probability distribution for demand during

the lead time. We describe the

options on the dialog below.

Infinite or Finite Replenishment Rate

| Infinite Rate

|

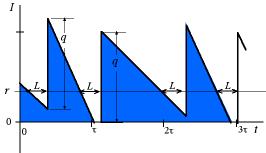

For the finite replenishment

rate, orders arrive in whole lots. The figure illustrates

the case where shortages are backordered. The inventory

level rises from its lowest level to an amount q

greater than the lowest level. The lead time (L)

and reorder point (r) are important for the (q,

r) system as the uncertainty of demand during the

lead time determines the cost of the system. If the lead

time were zero, the minimum inventory level would be zero

in each cycle and the maximum inventory would be q. |

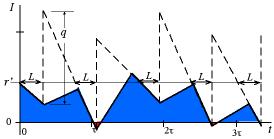

| Finite Rate

|

The same pattern of demand is shown at

the left for a finite rate system. This has the same shortages

as the infinite case as indicated by the equal time intervals

during which shortages occur. The average inventory and

backorder levels are reduced because replenishment amounts

arrive at a finite rate rather than an infinite rate.

Notice that the time intervals in which production is

actually taking place are equal. With a production rate

P, the interval is q/P. Since

the cycle times are not constant in the stochastic system,

the value of P must be great enough so that there

is a high probability that the complete lot is produced

before the next cycle starts. This is another penalty

associated with uncertainty. The production capacity must

have some excess to allow for the uncertainty in demand.

Our add-in requires that P >= D,

but does not enforce excess capacity.

Because the low points in inventory occur a little earlier

for the finite case than the infinite case, the reorder

point must be a little higher for the finite case than

the infinite case (r' > r). Because the approximations

used by the add-ins, this feature is not reflected in

the add-in results. |

Demand Probability Distribution

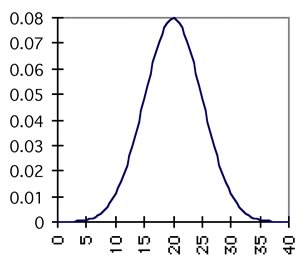

Poisson Distribution

|

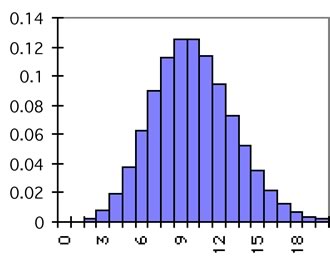

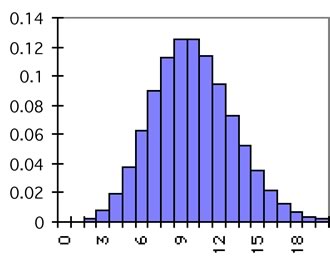

The uncertainty modeled is the demand during

the lead time. When the average demand per time interval

is D and the lead time is L, the average

demand during the lead time is DL. The Poisson

distribution is appropriate when demand events occur independently

and in single units. The parameter of the Poisson is its

mean value (DL). The standard deviation of the

Poisson is the square root of the mean. The figure shows

the Poisson distribution with a mean value of 10. Excel

has built-in functions to evaluate both the individual

probabilities and the cumulative distribution.

When the mean demand is greater than 30 it is difficult

to evaluate the Poisson probabilities accurately, so we

use the Normal distribution as an approximation. |

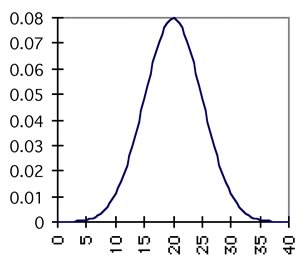

Normal Distribution

|

The normal distribution is a good approximation of

the Poisson for larger values of the mean. This option

uses a Normal distribution with mean DL. The

standard deviation is an input parameter. For some problems

it is interesting to vary the standard deviation to observe

the effects of uncertainty. If the Normal is to approximate

the Poisson, the standard deviation should set equal to

the square root of the mean.

It is convenient to have the parameters of the distribution

depend directly on the lead time. Then we can experiment

with different lead times without redefining the parameters.

Excel has built-in functions to evaluate the density

function and cumulative distribution of the Normal distribution. |

| Normal-LT |

For this option, the distribution of the demand during

the lead time does not explicitly depend on L.

Rather, both the mean and standard deviation are input parameters.

This is convenient for some problems, but in reality the

distribution of demand does depend on the lead time. |

Backorders or Lost Sales

|

We have illustrated the backorder case in

the previous figures. In the figure we illustrate the lost

sales case. Here whenever a shortage occurs, the customer

is not served. When a replenishment arrives after a shortage

interval, the inventory rises to the level q because

there is no need to deliver backordered items. |

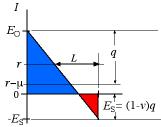

Shortage Cost

| Shortages Backordered

|

The figure shows an inventory

cycle assuming shortages are backordered. The cycle shows

the relevant expected values. Of course a sample cycle

will be different than shown because the demand during

the lead time may be less than r and no shortage

will be observed. In fact, the theoretical development

of stochastic inventories assume that shortages are rare

events. Some notation in the figure is defined below.

For the backorder case, we have three alternatives

for the cost experienced when a shortage occurs.

Cost per shortage event: Here there is an expense

in every cycle where a shortage occurs. The expected

shortage cost in a cycle is:

|

| Cost per unit short: Here there

is an expense for every unit that is demanded when

the inventory position is negative. The expected

shortage cost in a cycle is:

|

Cost per unit-time short: Here there is an expense

for every unit that is demanded when the inventory

position is negative. The expense is proportional

to the time spent in a backordered position. The

expected shortage cost in a cycle is:

|

|

Lost Sales

|

Cost per lost sales: Here there is an

expense for every unit that is demanded when on-hand inventory

is zero. A cycle of inventory appears in the figure with

expected values. The expected shortage cost in a cycle

is:

|

With stochastic models, additional parameters must be defined

as illustrated in the Parameters dialog below. The parameters

available depend on the options selected.

The parameters include the stochastic parameters that define

the probability distribution. For the Poisson distribution the

demand mean and standard deviation are entirely determined by

the expected demand during the lead time. For the Normal distribution,

the mean is the expected demand during the lead time, but we

specify the standard deviation. For the Normal LT option, we

specify the mean and standard deviation of the demand during

the lead time. The dialog above results if the Normal LT options

is chosen for on the inventory definition dialog.

One additional parameter is the Maximum Probability Short.

For stochastic models, the reorder point determines the risk

that the inventory will be exhausted during a cycle. Designers

often want to limit this to some small value. We provide this

option with this parameter. Optimum solutions are limited to

assure that this maximum is not exceeded.

The number of display options is also increased for a stochastic

model as shown below. The two options

on the bottom are only relevant when demand is random.

|