|

|

|

Portfolio |

|

-Capacity

Portfolio

|

|

|

We consider here a portfolio that consists

of the machines used for processing in a manufacturing

or service system. The system consists of several stations

where processing takes place and where finished or intermediate

products are withdrawn and sold. Sales cause flow through

one or more stations. To handle that flow machines of

fixed capacity must be purchased. Machines require investment

and incur operating costs. One measure for the system

is the profit which is the revenue from sales less the

costs of manufacture. The model will include a constraint

on minimum profit. The model will also include a budget

constraint on the total initial investment.

As the amount of flow increases through a fixed capacity

machine, congestion grows in a nonlinear manner. This

is best illustrated by the queues of a queuing network.

We consider congestion in our model as the objective to

be minimized.

We build a nonlinear-integer mathematical programming

model that considers congestion, profit and investment.

The data for the problem is described on this page. The

mathematical programming model is described on the next

page. To create a model choose Capacity from

the Portfolio menu. |

The dialog below accepts the structural data for the system.

Projects will provide capacity for stations that carry flow.

The number of projects must be at least equal to the number

of stations. The MARR is the minimum acceptable rate of return

used for financial calculations. This must be expressed in terms

of the time interval specified on the dialog, weeks in the example.

The drive option, Push or Pull, is selected

by the buttons on the right of the dialog.

In the following sections, we describe the various

data items required by the analysis.

System Drive and Structure

| |

The drive and structure options

for a system are also used for inventory

analysis, process

flow analysis and queuing

networks. For more detail, please see these discussions.

We provide here only a brief survey.

The simplest pull and push systems have all stations

arranged in a line as shown at the left. For a pull system,

flow is pulled from the system at the station outputs.

Flow pulled from station 5 passes through all the preceding

stations. Although the figure shows output only at station

5, the models allow flow to be pulled from any station.

Pull systems usually represent manufacturing systems where

the products are sold after they are pulled.

For a push system, flow is pushed into the system at

the station inputs. Flow pushed into station 1 passes

through all the following stations. Although the figure

shows input only at station 1, the models allow flow to

be pushed into any station. Push systems usually represent

service systems where customers receive a variety of services

after they enter the system. |

|

Push Network |

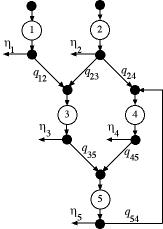

More complicated systems are described as networks.The

figure shows the push system used by the example. The

structure of the system is described by the square transfer

matrix P.

For some applications the components of the matrix represent

probabilities, but more generally the value  is the flow passed to station j per unit of flow

passing through station i. The value of

is the flow passed to station j per unit of flow

passing through station i. The value of  may be any positive quantity and rows of the matrix need

not sum to 1. The matrix used for the example is below.

Note that the flow at station 1 is split to go to stations

2 and 3. The last row indicates that 10% of the flow leaving

station 5 is returned to station 3 for reprocessing.

may be any positive quantity and rows of the matrix need

not sum to 1. The matrix used for the example is below.

Note that the flow at station 1 is split to go to stations

2 and 3. The last row indicates that 10% of the flow leaving

station 5 is returned to station 3 for reprocessing.

Flow may enter at any station, but it is

not necessary to define where the flow leaves. Given the

entering flows, the flow in each station is determined

by the solution of a set of equations involving P. |

|

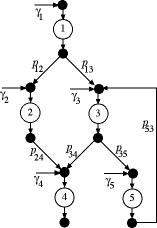

Pull Network |

The figure at the left shows a pull system

with 5 stations. The network structure of the pull system

is described by the matrix Q. The component

is the flow leaving node i per unit of flow passing

through node j. Again the components of the matrix

must be nonnegative.

is the flow leaving node i per unit of flow passing

through node j. Again the components of the matrix

must be nonnegative.

An example is provided by the matrix below.

The columns of Q describe the

inputs to a station. For example, column 5 indicates that

for every unit passing through station 5, one unit must

pass through each of stations 3 and 4. This is typical

for an assembly station.

For the pull system, the flows through all

stations are governed by the flows pulled from the system.

The solution of a set of linear equations involving Q

determines the station flows. |

The specification of either P

or Q is part of the data for the Capacity

Portfolio model.

|

Portfolio Data

|

After specifying the

model parameters and selecting the drive option, the program

constructs a math programming model based on a variety of data

that must be entered on the forms provided on the worksheet.

The data area is located immediately below the constraint area

of the model. For the example, this is row 30 of the worksheet.

Three data items must be entered to describe the general features

of the portfolio: the MARR (H31), the minimum value of the present

worth (L32), and the amount of the budget available (L33). The

dialog specifies the time interval as one week (Wk). The MARR

is the minimum required rate of return per week. The value entered

represents roughly 25% per year. We will have more to say about

the time interval selection later. The other cells on the form

below are filled by equations (H32, H33) or by algorithm computations

(L31).

|

Project Data |

| |

Project data appears in the rows

following the Portfolio data. There must be at least one project

for each station. The data describing a project involves providing

a single machine. Part of the problem is to determine the optimum

number of machines.

A machine processes flow, and the data for one machine is shown

in each column. Time dimensioned quantities are given in the

time interval measure, week for the example. Each machine requires

a investment expenditure at time 0 given in row 37. In every

time interval during the machine's life there is an operating

cost expenditure as given in row 38. Row 39 gives the salvage

value of the machine at the end of its life. We have chosen

0 for all projects. The machine lives are specified in row 40.

Since one week is the time interval for the example, the quantities

in row 40 are in weeks. The financial quantities are combined

using Excel financial functions to obtain a net cost per week

in row 46. For a normal project the Investment, operating cost

and salvage value are entered as positive numbers, although,

investment and operating costs are cash outflows and the salvage

value is a cash inflow.

The math program will select the number of machines of each

type that optimizes the objective function. The minimum and

maximum number of machines (servers for a queue station) are

given in rows 41 and 42. The capacity, entered in row 43, is

the amount flow that can be handled by a single machine at a

station. For example, the N1 machine has a capacity of 37. If

the flow through station 1 is greater than 37, certainly more

than one of machine N1 must be provided.

The model will determine congestion with formulas from queuing

theory. These formulas are based on the assumptions that the

times between arrivals and the service times for stations are

exponentially distributed. There are adjustments to these formulas

when the service time variability is reduced. The Coefficient

of Variation (COV) is the standard deviation of the service

time divided by the mean service time. For exponential distributions

the COV is 1, however, we provide the data item on row 44 to

allow other values. Finally there is a component of operating

cost that is linearly related to the flow through the machine.

We call this the Processing Cost and enter values of the cost

per unit in row 45.

Rows 47 and 48 hold values provided by the solution of the

model. These values are 0 before the problem has been solved. |

Station Data |

| |

The stations have data in columns

H through L starting for the example in row 50. The unit profit

in row 52 is unit sales revenue less raw materials cost. The

sales volumes at the stations are variables in the model and

the minimum and maximum sales are in rows 53 and 54. Recall

that sales are pushed into station inputs for a push system,

and sales are pulled from the outputs of the stations for pull

systems. Rather than process the flow at the station, we allow

the processing to be outsourced. The cost and WIP for outsourced

units are in rows 55 and 56. Rows 57 and 58 report the results

of the optimization and are initially 0.

|

Transfer Data |

| |

|

The transfer rates from one station to

the next are given by the entries in P

matrix starting at row 61. The example at the left is

represented by matrix below. The Augmented Matrix

is determined from the P matrix.

The inverse of the augmented matrix is used by the model

to compute the flow through the stations.

|

The model that uses this data is on the next page. |

|